If you’ve gone through my site, you’ll know that I provide solid advice on how to eliminate your tax debt. Time and again though, I emphasize that some problems are too complex for you to handle alone.

Yes, you can apply for an installment agreement or offer in compromise by yourself. But, how successful you’ll be depends on whether you can get expert guidance.

I’ll be the first to put my hand up and say that you won’t be able to solve your tax debt problems just by following the guides on this site. Huh, why is that?

Solutions to tax debt problems are never one-size-fits-all. There are too many differences in your financial situation, IRS account statuses etc. There will never be one piece of advice that will settle your tax debt issues once and for all.

That’s where tax relief companies come in. They are experts with the experience to help you according to your specific needs.

In this article, I’ll show you what you should look for in an honest and effective tax relief company. When doing your research, just remember that not all tax relief companies are created equal.

At the end of this article you’ll be able to download a checklist that you can use in your research. I’ll also provide many examples using one of the most honest tax relief firms I know – Community Tax.

So when looking for a tax relief company, how do you tell which ones are the most legit?

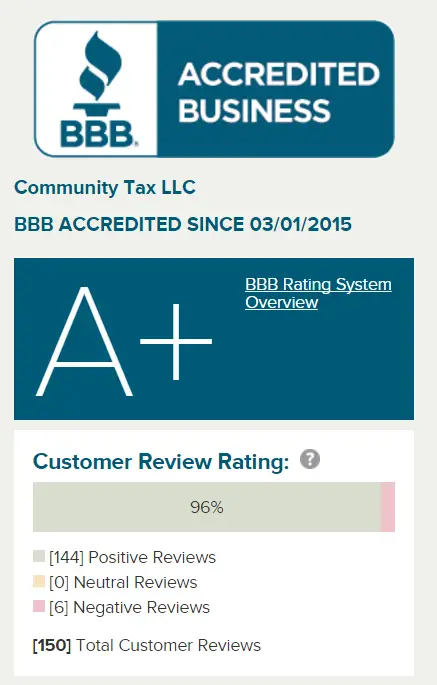

1. They have a high BBB rating

The Better Business Bureau (BBB) is a ratings agency that rates companies from F (lowest) to A+ (highest). The rating is based on 13 factors which include:

- Complaint history – how many customers have complained about the business and how did the business go about resolving the issue

- Transparent business practices – the company provides clear information about its services and provides a legitimate address etc.

- Time in business – how long the business has been operating. This is especially important for tax relief companies. I’ll explain why in a bit.

An A+ rating generally indicates that you can expect a high level of customer care and professionalism when interacting with the company.

My advice is to look for tax relief companies that have an A rating or higher. Of course, if you’re spoilt for choice, you can’t really go wrong with an A+ rated company.

I’ve put this as the top thing to look at because the BBB rating is given based on a variety of factors. So you don’t have to do the investigation yourself. You merely have to look at one rating to get a pretty good idea of how trustworthy a company is.

2. They advertise services relating to your problem

Look at the website of the company you’re engaging.

Do they list a solution to your specific problem? Do they have case studies about others who were in your position? What did they do to resolve those cases?

Example of a tax relief company showing the services that they offer.

If a company that fails to mention your problem on your website, then they may not have the expertise to deal with your particular situation.

Just checking that the tax relief expert has a solution to your problem seems painfully obvious. However, it is something that people overlook all the time.

Such people go back and forth with a tax relief expert who has no clue how to deal with their tax debt problem.

In the end, the client ends up at square one after spending thousands of dollars and many hours. Don’t let this happen to you!

3. They offer free consultation services

Most legit tax relief companies will offer a free consultation to briefly understand your tax debt issue. They’ll also offer some advice on whether they can help you and what to expect going forward.

Most tax relief companies, like Community Tax, provide free consultations with no-risk.

If any company promises you anything before they understand what’s required, then you should be sceptical. Worse, if a company requires you to put down money before they even understand your needs, then run far away!

My advice is, use the free consultation with each company when you’re deciding between different tax relief companies. This carries two benefits:

- You get free basic advice from different experts, and

- You get to see how the tax relief company treats its customers. You really want to work with someone who is on your side and treats you with respect!

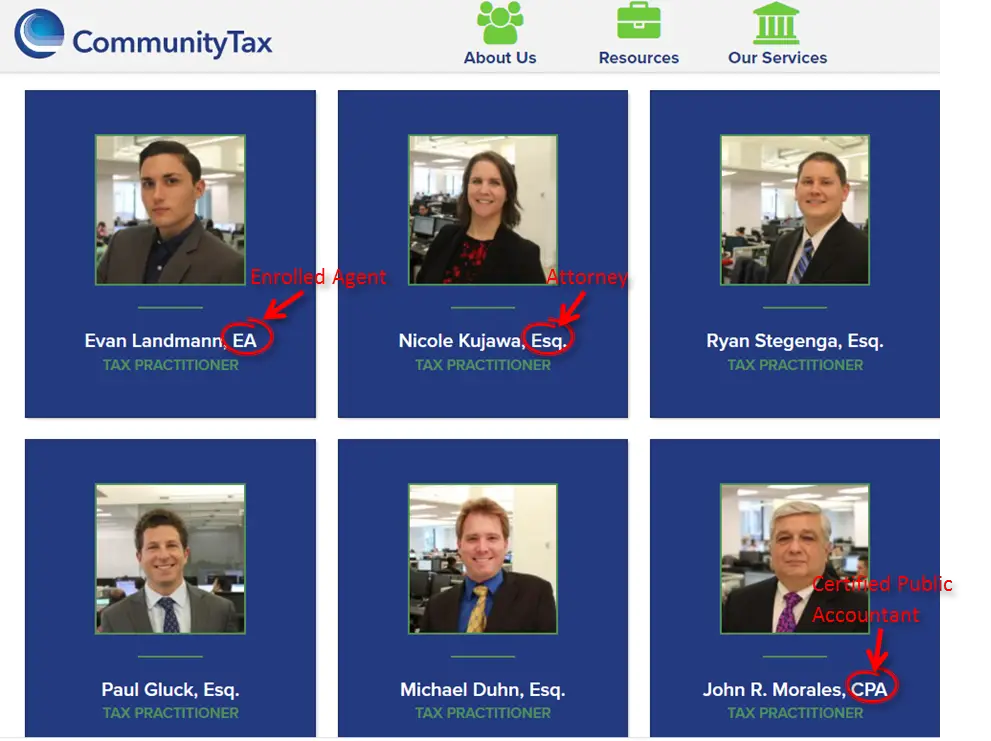

4. They have qualified representatives

Sometimes people put their absolute trust in a tax relief company merely because they claim to have “tax relief professionals.”

Just because a person deals with IRS debt issues for a living, doesn’t mean that they’re necessarily qualified to do it. This is something that’s very important for you to understand:

Only certain people are allowed to represent you in front of the IRS.

So what kinds of people are allowed to represent you? People with the following qualifications are allowed to deal with the IRS on your behalf:

- Tax attorneys

- Certified Public Accountants (CPA)

- Enrolled Agents (EA)

Each of these experts has a different area of expertise. For example, a tax attorney would have good knowledge of tax law and IRS regulations, an EA would be experienced in compiling your tax documents in dealing with the IRS.

Look for a company that has a good mix of qualified experts. That means they have Tax attorneys, CPAs and EAs on staff.

This is how you identify if the tax relief company has a good mix of EAs, Tax Attorneys and CPAs

While they may not all work on your case at once, your mind should be put at ease knowing that the tax relief firm has a large pool of expertise that they can tap into if your case manager gets stuck.

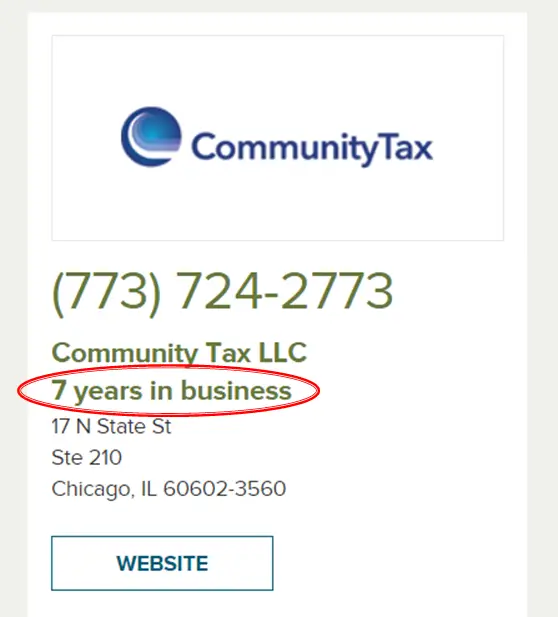

5. They have a long service history

In my book, you should look to hire a tax debt resolution company that has been in business for 5 years or more.

Why is being in business for a long time important?

- If a firm can operate for 5 years without being shut down or rack up massive complaints on BBB, it’s a solid indication that they run a legitimate and honest business.

- 5 years is enough time for a company to see a full gamut of tax debt issues. You can be confident that they have heaps of experience and will already know what to do with your case.

Tip: Instead of taking the company’s word for it, check their service history on the BBB website. This will ensure you get a transparent third-party report on their service history.

Community Tax’s service history is 7 years as reported on the BBB website.

You might be thinking, the BBB already factors in service history when issuing a rating. So why double check?

I still think you should check because a company that has been in business for a short period of time can technically still get a high BBB rating if they score well in the other metrics.

A BBB rating is merely an aggregate rating that encompasses many factors.

6. They’re enthusiastic about replying to your queries

A good tax relief expert understands that you’re anxious about the outcome of your tax resolution. They’ll do their best to answer your questions and keep you updated with their progress.

While having a specialist representing you in front of the IRS should be enough comfort, having a proactive expert reporting back to you on your tax resolution status can provide you with the security you need to sleep easy at night.

You can use the free consultation to gauge how involved the company is in answering your questions. An enthusiastic representative can tell you a lot about the company’s attitude towards customer care. You can also ask what to expect in terms of correspondence with your case manager.

7. They charge low upfront fees

The most honest tax relief companies offer a two-step resolution process. What does this mean?

It means that to solve your tax debt issues, they go through two steps:

- Step 1: Investigate your IRS account and financial information. They’ll then determine how complex it will be and create a plan of attack.

- Step 2: Gather in depth financial information and supporting documents to prepare a solid proposal for submission to the IRS/State

Usually, an honest tax debt company will charge you a smaller fee for step 1 than in step 2. This is because they are merely investigating your tax debt situation and not really solving it.

Then in step 2, they’ll charge you a fee proportionate to the size of your problem.

Some companies like Community Tax offer a flat fee of $499 for step 1. Flat fees are seriously good because you know exactly what you’re getting into at the start, and won’t have any surprises from crazy ballooning fees.

By the time you reach step 2, the tax relief company already knows how much time they’ll need with your case. So they’re able to provide you with a more accurate quote. Again, you’ll have the choice of accepting the quote and proceeding. This means no nasty surprises.

8. They serves most states

An easy way to eliminate most tax relief companies is by looking at which states they serve. Obviously, you can’t enlist the help of one that doesn’t work with your state.

If you’re dealing with federal tax debt issues though, I’d recommend going for a company that serves many different states.

While you may feel better about working with a local company that’s located close to you, these are often smaller companies that may lack the experience in dealing with tax debt issues.

A company that has the resources to accommodate clients from all over the country usually is big enough with deep experience in dealing with the IRS.

9. They have low, or no minimum threshold

Some tax relief companies set a minimum threshold before they will deal with your tax debt. This threshold is usually $10,000. What does this mean?

It means that you will not be able to enlist their services if your tax debt is below $10,000.

While rare, some companies will work with you even if you have tax debt below $10,000. This is alone is great news for people with small tax debts.

However, this can also be beneficial for people with large outstanding debt.

How so?

If the company is able to work on small tax debt issues (meaning that they make a smaller fee on the job), it shows that the company is cost efficient in dealing with tax debt, and is not ripping its smaller customers off by charging a huge margin to deal with your tax debt problems.

If they’re able to come through effectively for small customers, then you can probably trust that they’ll apply those same cost efficient practices for larger tax debts like yours.

Community Tax is one of these rare companies that are willing to work with tax debt that is less than $10,000.

Conclusion

I hope you’ve gained some insights from this article about how to determine if a tax relief company is legit. The next step would be to go out and with a checklist of these items and find a tax relief company that meets these requirements.

If you’re not interested in reinventing the wheel, you can cut down on hours of research and read my article on why you should choose Community Tax to resolve your tax debt problems.

If you still want to get out there and do more research, you can download the checklist here.